Looking to Legally Recover Money You're Owed but Don't Know Where to Start?

Mymoneyclaim.co.uk provides free, independent support and guidance to individuals or businesses that are making a legal claim to recover money owed to them.

How Can We Help?

Mymoneyclaim.co.uk provides free resources providing information, support and guidance to individuals looking to start a legal claim to recover money they are rightfully owed.

Starting a legal claim can be daunting, often leading to unnecessary stress and worry and in many instances, the complexities of the process discourages people to recover what is theirs.

There are often many questions such as:

- Where do I Start?

- How Much Will it Cost?

and - How Difficult is It to Make a Claim?

All of which and more are answered in the free, comprehensive Guide to Recovery.

- During an initial consultation, we will carry out a full assessment of your case and identify the best approach for removal of your CCJ.

- A specialist will then be allocated to work alongside you at all times to communicate with the claimant and complete all the relevant paperwork to submit to the court for the removal of your CCJ.

- We ensure delivery of your paperwork to the relevant court for submission and approval. When your CCJ is removed you will receive the relevant paperwork and we will then contact all credit reference agencies to ensure your file is updated.

The Importance of CCJ Removal

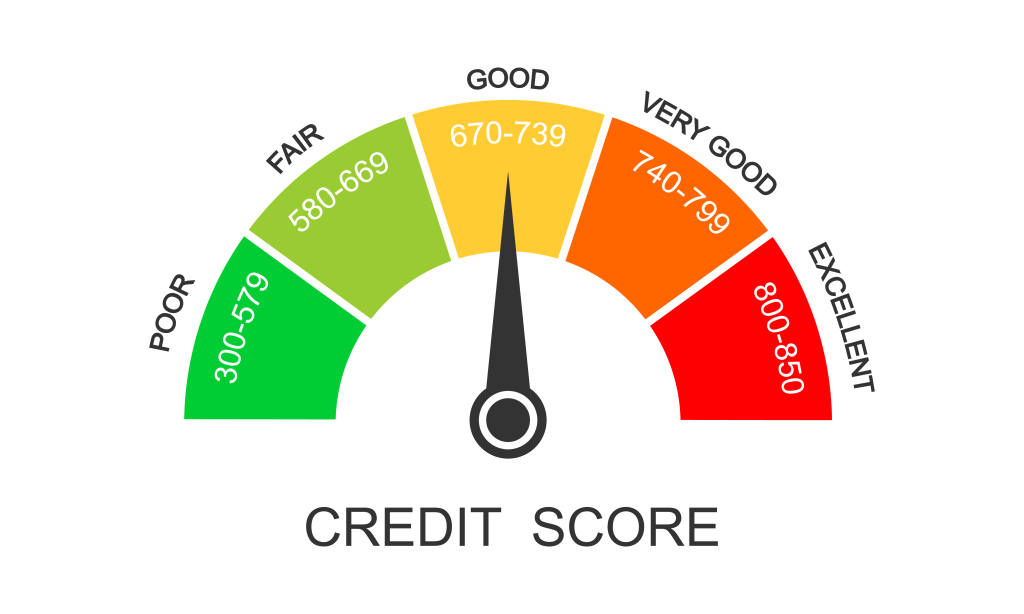

Having an active CCJ on your file can have a detrimental impact on your ability to utilise finance options that would otherwise be available to you as lenders will immediately view you as “high risk” without a full understanding of the circumstances.

- Vastly increase your chances of getting accepted for a Mortgage or Rental Application

- Access Vehicle Finance, Personal Loans or Credit Cards

- Improve your current interest rate on your existing borrowing by reducing perceived lender risk

- Increase your credit score by up to 250 points.

What Our Clients Say

Kingsley Legal Group got to the source of the problem quickly and the CCJ is no longer on my companies credit file

Frequently Asked Questions

Is this just for individuals or can businesses also use your service?

The legal process is very similar between individuals and businesses in terms of a CCJ being placed on the credit file and as a result, we can assist both businesses and individuals.

Can you definitely remove the CCJ?

In most cases, yes however, we will carry out a full review of your case before any work is carried out to identify if we can assist.

Will removing a CCJ improve my credit score?

Yes. If you have a strong credit history other than the CCJ, your credit score could increase by up to 250 points. A low to average credit history can still see a typical increase of 150 points.

Court intimidates me, will I have to go?

It’s very rare that a court hearing is required and if so, we can arrange for an advocate to attend in your absence.

How long does the process take?

Our aim is to work with you to get the paperwork submitted to the courts as soon as possible. The court system varies in the time it takes to approve the paperwork however, we’ll stay on hand and work to get the results for you as quickly as possible.

Does it matter who issued the CCJ?

No. Our process is designed to work with all claimants in order to get your CCJ set aside.

Do you assist with CCJ's issued by parking enforcement?

Yes. Parking enforcement CCJ’s are a large part of our workload and would be happy to help remove these from your credit file.

Who Are We?

Mymoneyclaim.co.uk is part of Kingsley Legal Group – a leader in Debt Recovery and Restructuring solutions.

With a leadership team holding in excess of 15 years experience operating in the legal and debt industry, our results speak for themselves

Why removing a CCJ is important

CCJ’s can have a huge impact on the quality of life of the recipient for a period of up to 6 years, if it isn’t addressed. Simply by having a CCJ on your credit file restricts your ability to move home, upgrade your car, apply for a loan or credit card or even open a bank account.

With over 26,000 CCJ’s issued within the last three months of 2023 and with over 4,000,000 CCJ’s sitting on individuals credit files, too often are people affected by the impact of this.

In many cases CCJs are registered against individuals without them knowing they owe the debt, the legal process not being followed properly and judgement being made against them without their knowledge.

- Boost Your Credit Score

- Increase Financial Opportunities

- Protect Your Future